california renters credit turbotax

California Resident Income Tax Return Form 540 line 46. Federal law lacks a credit comparable to the states Renters Credit.

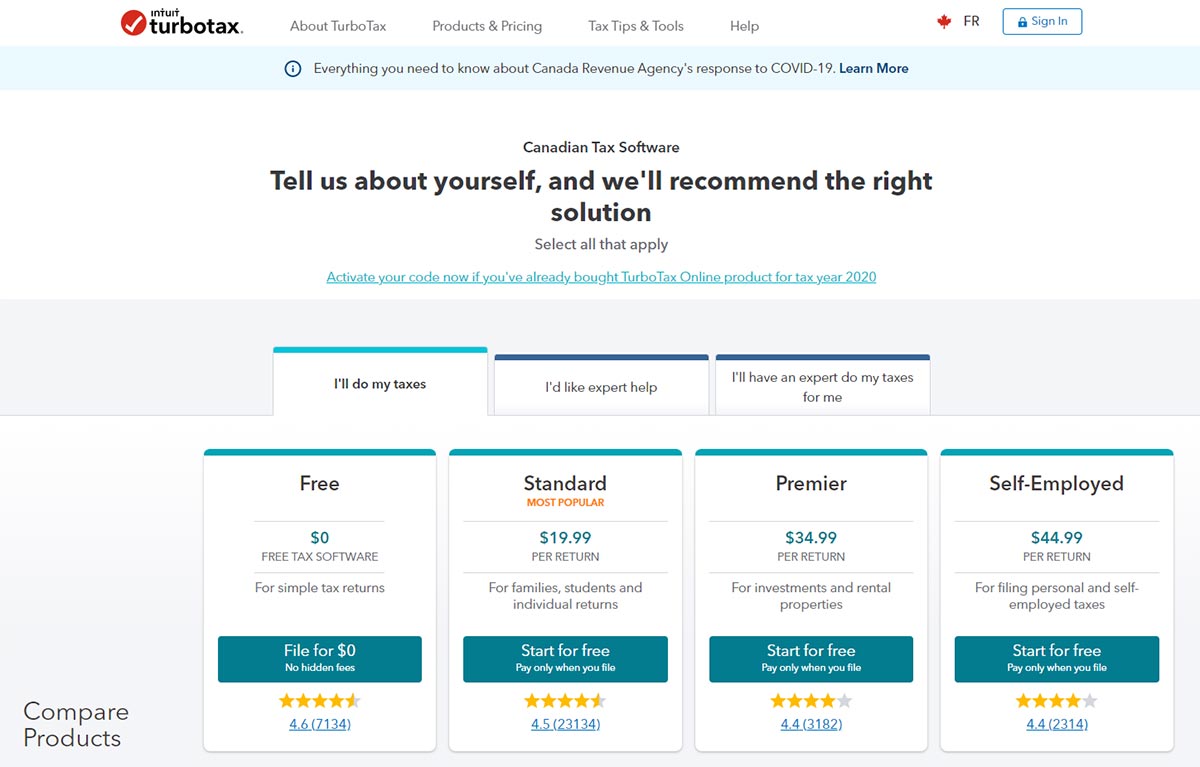

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

Lacerte will determine the amount of credit based on the tax return information.

. Some credits such as the earned income credit are refundable which means that you still receive the full amount of the credit even if the credit. 60 for single or married filing separately with an adjusted gross income AGI of 40078 or less and. Use one of the following forms when filing.

File your income tax return. Depending upon the CA main form used the output will appear on Line 46 of the Form 540 or Line 19 of Form 540 2EZ. Posted by 1 year ago.

SOLVED by Intuit Lacerte Tax 11 Updated 3 days ago. Client paid rent in California for at least half the year. It just says you need to have paid rent for half the year and a couple of other things that I meet.

To claim the California renters credit your income must be less than 40078 if youre single or 80156 if youre filing jointly. Current state law allows a nonrefundable credit for qualified renters in the following amounts for tax year 2017. To qualify for the CA renters credit.

Go to Screen 53 Other Credits and select California Other Credits. You may qualify if you have earned income of less than 14162 You do not need a child to qualify but must file a California tax return to claim the credit. Some people said TurboTax hand holds you a bit better but FreeTaxUsa was just as easy and thorough.

A proposal in the state Senate would increase Californias renters tax credit from 60 to 500 for eligible single tax filers and more for those who are married or. Widower How to claim. To qualify for the CA renters credit.

1040 California CA California allows a nonrefundable renters credit for certain individuals. I am a college student filing independent. Depending upon the CA main form used the output will appear on ine 46 of the Form 540 or line 19 of Form 540 2EZ.

60 credit if you are. I lived on a off-campus apartment and my name is on a lease so I do pay rent. When the yearly tax credit was established decades ago in.

EITC reduces your California tax obligation or allows a refund if no California tax is due. The taxpayer must be a resident of California for the entire year if filing Form 540 or at least six months if filing Form 540NR as a part-year resident. You must be a California resident for the tax year youre claiming the renters credit.

I have proof of this through the checks written out to my dad. The other eligibility requirements are as follows. The 2019 earnings limits are 42932 single and 85864 married.

I was also pleasantly surprised that they give you the option to import the TurboTax file from. Several states also provide tax relief for renters who dont meet age or disability criteria. Use Screen 53013 California Other Credits to enter information for the Renters credit.

Credit EIC but with different income limitations. Check the box Qualified renter. Neither you nor your spouse if married was granted a homeowners property tax exemption during 2021.

Renters in California may qualify for up to 120 in tax credits. I saw a lot of recommendations on this sub for FreeTaxUsa and I was worried at first. You rented property for more than half the year that was not exempt from California property tax in 2021.

See How to Generate the California Renters Credit for more information. Renters Credit on TurboTax Did you pay rent for at least half of 2019 on property in California that was your principal residence is what they asked. The rent is paid my dad but my brother and me give him money.

The program will determine the amount of credit based on the tax return information. You paid rent for a minimum of six months for your principal residence. I dont see anything from the IRS saying there is a limit on how many people in a household can claim this credit.

For example if you owe 1000 in federal taxes but are eligible for a 1000 tax credit your net liability drops to zero. Renters Credit on TurboTax. Today the renters credit is 60 for single filers and 120 for joint filers.

A tax credit is a dollar-for-dollar reduction of the income tax you owe. FreeTaxUsa was great and you can import TurboTax details. To claim the CA renters credit.

You can still qualify for the credit even. Client paid rent in. Clients California adjusted gross income AGI.

If you rent your home in California for at least six months of the year and make less than 43533 single filer or 87066 filing jointly you are eligible for the annual California renters credit. Exempt property includes most government-owned buildings church-owned parsonages college dormitories and military barracks. 120 credit if your are.

To claim the renters credit for California all of the following criteria must be met. Each state has its own regulations around a renters tax credit.

Turbotax Review 2022 Pros And Cons

Irs Form 540 California Resident Income Tax Return

Turbotax Review 2022 Pros And Cons

Home Office Deductions For Self Employed And Employed Taxpayers 2022 Turbotax Canada Tips

Turbotax A Review Best Tax Return Software In Canada Insurdinary

Intuit To Send Millions Of Turbotax Refunds After Settlement Money

Quebec Property Owners Rl 31 Slips And The Solidarity Tax Credit

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

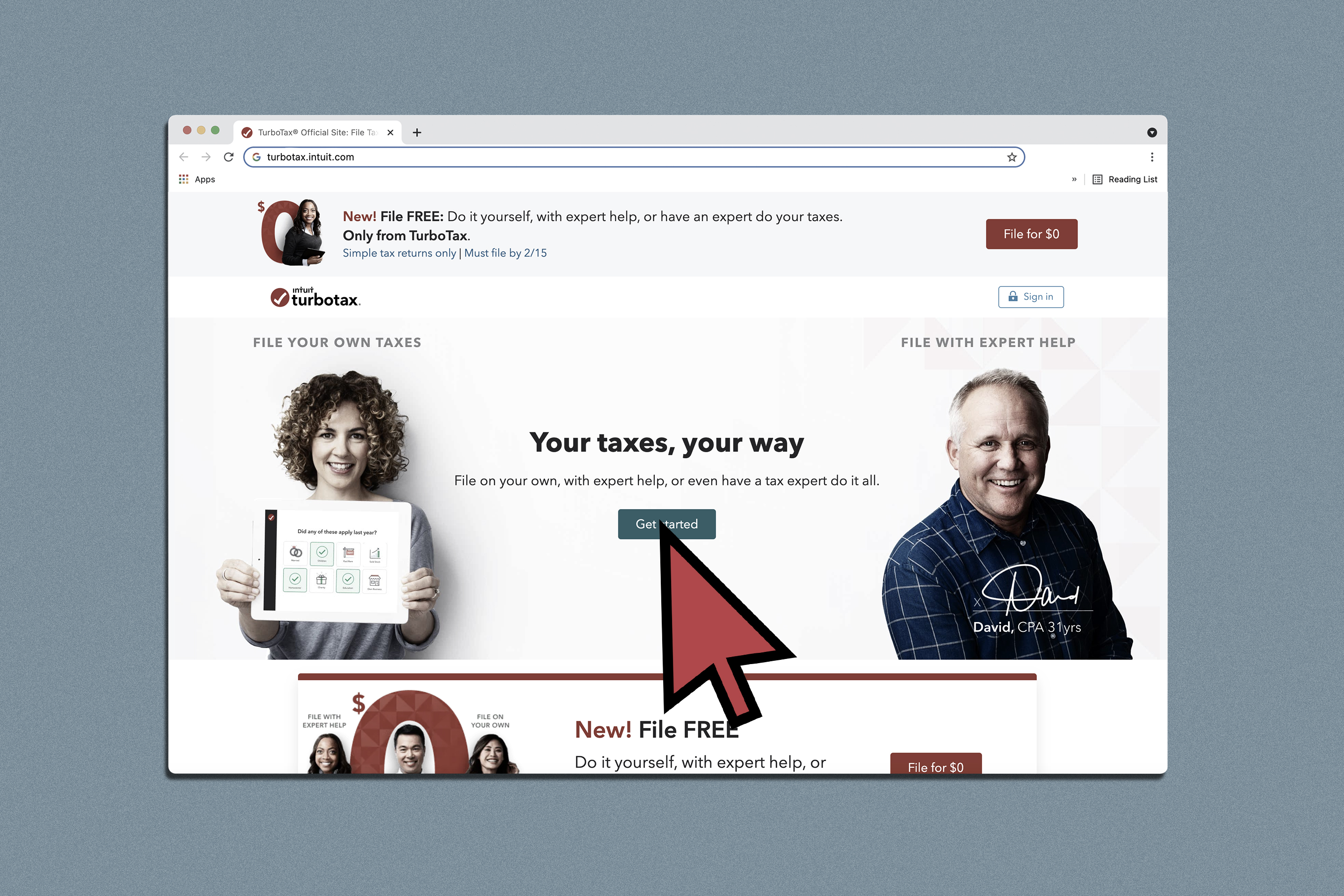

How To File Taxes For Free Turbotax 2022 Free File Change Money

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

Credit Cards Offering Tax Service Saving Rewards In 2022 Nextadvisor With Time

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

Irs Form 540 California Resident Income Tax Return

Turbo Tax Opts Out Of Irs S Free File Program Newsnation

What Is A Good Credit Score For Renting A Home

11 States That Give Renters A Tax Credit

How To File Taxes For Free In 2022 Money

Can You Pay Taxes With Your Credit Card Nextadvisor With Time